Szymon's Zettelkasten

Powered by 🌱Roam GardenP: How to thrive in a Black Swan dominated world

Keywords:: PermanentNote makePublic

Reference::

Black Swans dominate our reality. Because of its extreme impact, one Black Swan can invalidate all of your assumptions derived from thousands of years of confirmatory sightings. Further, if you're operating in Extremistan, most of your results will come from Black Swans of the positive kind. In other words, unless you're a hunter-gatherer, Black Swans are an imperative part of your reality.

The question is, how to survive in a Black Swan dominated world. Or better, how to thrive in such world?

First, understand that you can't predict Black Swans due to our biological limitations. Further, our mental limitations make us oblivious to Black Swans which is amplified in our increasingly Extremistan world.

Second, once you know you can't predict Black Swans, adjust rather than try to predict them. This means:

In the macro, you must apply the Barbell Strategy to areas of your life that reside in the Extremistan. This means avoiding and insuring against negative Black Swans. Increasing your exposure to Black Swans of the positive kind. TK P: Barbell Strategy (This is for the macro)

We can't predict the probability of Black Swans. What we can do, however, determine their potential impact.

How big will it be and will it be positive or negative.

In general, you should insure yourself on Black Swans and increase your exposure to positive ones.

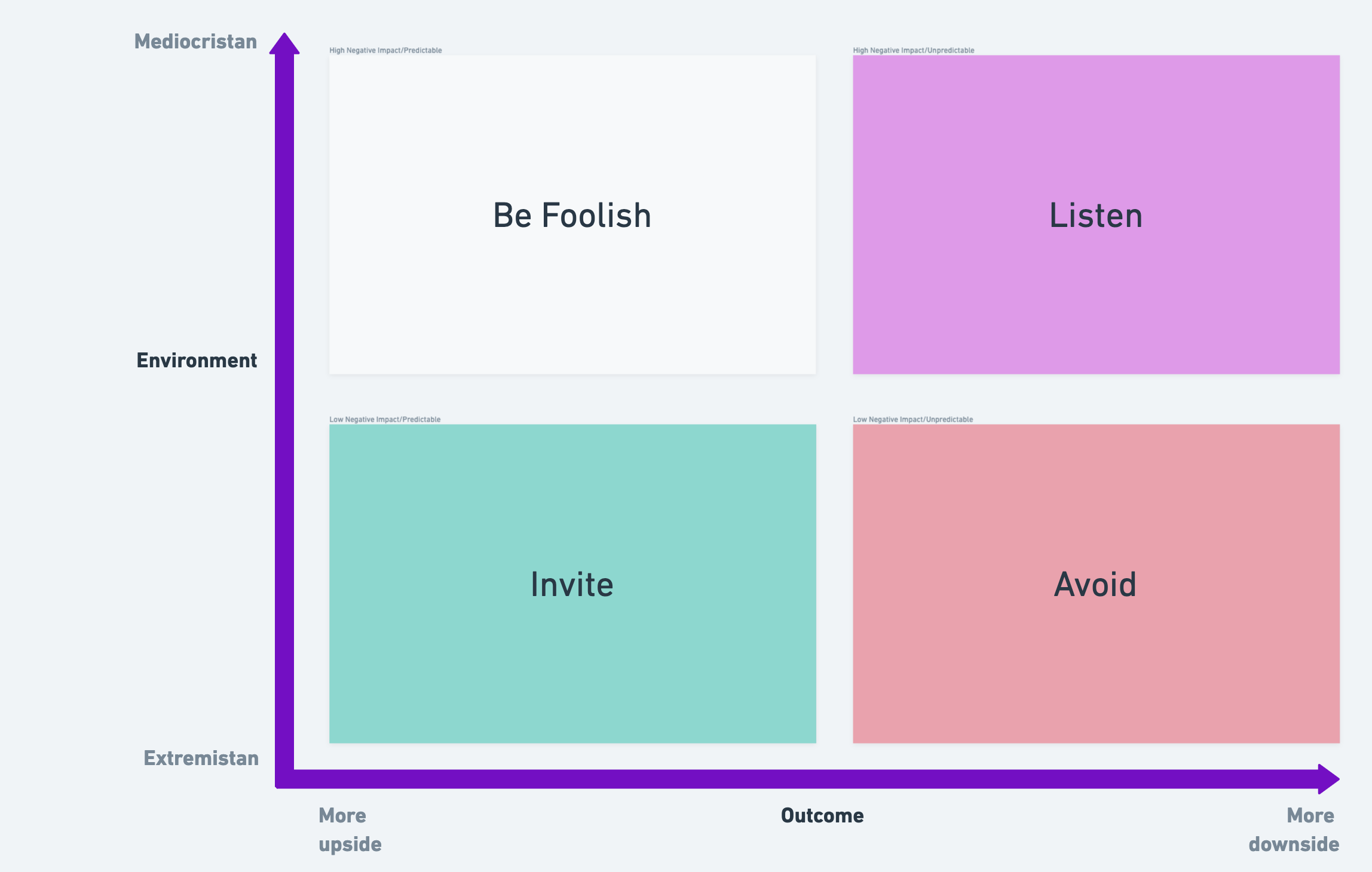

It's helpful to look at reality using two features: predictability and high negative impact.

If something is predictable then it's almost certainly in Mediocristan.

Actually, investing 10-20% of resources into Extremistan things is the way to thrive in the modern world, isn't it? If you wanna succeed, you wanna ask yourself, what extremistan thing you can invest your time into and slowly change the proportion of Mediocristan (exchanging time for money) and Extremistan (making money work for you).

Innovation is the result of luck (positive black swans)

Your success isn't luckless

Be grateful for your blessings because, especially if you're in an Extremistan environment, almost certainly luck played a role in your success. But as luck can give you it can also take away. Therefore, to preserve it, become more conservative, and humble with the gifts you received from the Goddess Fortune.

Relates to: PN: New possessions create obligations

Always try to discount your blessings because luck played a big role in them. This means not rising your living standards in proportion to your success but saving or investing this money.

The barbell strategy is also a great way to think about life in general. In each area of life create a barbell. Having a stable job? Find a side hustle in the extremistan. Having a stable and predictable life? Do one new crazy thing once a month. Meeting the same close friends all of the time? Go out for a party once a month. Eating every day? Fast once a month. Jogging every day? Sprint once a week.

In the micro to reduce the negative consequences of your Black Swan blindness you must apply different methods consisting of combining skepticism and empiricism. (this is for the micro)

Skepticism is what stops; empiricism is what validates.

Combine skepticism and empiricism to not get fooled by randomness

Absence of evidence doesn't mean evidence of absence.

Yet this is one of the main troubles with our minds. It's related to our epistemic arrogance.

Examples of breast feeding, removing tonsils, geocentricity, bad air, meditation, and so on.

To fight that you must be skeptical and empirical. Also, you must attain a beginner's mindset, accepting that you don't know it why.

The reason for that are the ones in the note about why we can't see Black Swans, right? In short, we compress reality, focus on the sensational, get tunnel vision, and become arrogant about what we know stripping away the dimensionality of reality, the nuances, the Black Swans.

Combine skepticism and empiricism to not get fooled by randomness

Skepticism is the blockade—you don't accept things at face value. You understand that reality is stranger than fiction because fiction has to make sense and our brains aren't made to make sense of reality because it's too complex (and we don't have of the information) and it wasn't evolutionary necessary, so your first instinct when you hear a theory—either someone's or yours—is to stop.

Empiricism—reasoning from experience—is your ultimate weapon against bias—confusing what we see with what there is. Until you prove a theory it has to stay a theory.

What with things we can't yet prove because we lack the tools to do it, like it was with meditation? Maybe here you should determine whether believing into the theory could kill you, and if it wouldn't, then who cares. You don't have to be paranoid everywhere.

But what about theories that can't be proven? (Are they even relevant if they're not testable?)

I think there are indirect ways like testing through analogy or testing parts of the theory.

Open-mindedness + skepticism + empiricism: this is a powerful three. (Btw., be open-minded and skeptical is Ray Dalio's approach as well)

Empiricism is also a weapon against our cognitive limitations. Although, we don't understand the causes of some things, through testing we can observe that they work. If we can make them work in a controlled fashion, the cause isn't as important, because the utility exists (i.e., accupuncture). Also if you have the utility, you have the motivation to pursue in that direction to finally find the cause (like happened with many discoveries). Further, this inspires action which is the main things for getting closer to the truth and innovation by exposing Black Swans hidden in our platonized reality.

Using skepticism as a shield (or something that stops) against ludic fallacy (stop and think).

Using empiricism as a guide in the Black Swan dominated world.

Using other tactics to limit the ludic fallacy (at least one for each bias, like narrative—don't make conclusions)

Third, you must balance your life by being foolish and paranoid in the right situations

How to survive in the Black Swan world?

Be human. Accept your fallacies. Don't always withhold judgement. Don't always avoid predicting.

Be fooled in small maters, not in the large.

We have two axes that should determine how we act in regards to the future: predictability and impact.

1: Unpredictability and high negative impact (financial forecasts, quitting your job without any plan; belief in God [do it]): avoid like fire, be skeptical and empirical, don't listen to experts' predictions, serious, mental, X. Be prepared, be hyper-conservative because these things can kill you.

2: Unpredictability and low negative impact (football match forecast; side-hustle; ): have fun, be foolish, be open-minded, try, maximize serendipity, embrace failures, hyper-aggressive

If the negative impact is low and it's unpredictable, then almost certainly the potential positive impact is high. This is the place where you can invest a small part of your resources (time, money, energy) to open yourself up for opportunities. This is the the Black Swans of the positive kind reside. So your goal here is to maximize serendipity. Seize any opportunity that offers potential extremistan outcomes. Expose yourself as much you can where positive asymmetric outcomes are much larger than unvavorable ones.

3: Predictability and high negative impact (doctor's diagnosis [tough not always], drugs, ): listen to experts,

4: Predictability and low negative impact (weather forecast (unless it's for a tornado or earthquake); gambling (unless it's betting your life's saving); missing the train (unless it's an evacuation from a city)): do whatever you want, it doesn't matter anyway

Predictability: Don't listen to forecasts in the Extremistan; listen to them and make them in the Mediocristan.

Impact: We can't avoid our irrationality. What we can do however is to avoid its impact. Therefore, be irrational in matters were being wrong doesn't have a detrimental impact—like planing your picnic or choosing what to wear. But don't let your irrationality fool you in big things that can kill you like predicting financial markets (just save), future trends, etc. There you want to cue out your System 1 and don't get into unnecessary risk.

This is the main lesson: we can't predict but we can avoid negative outcomes.

Be foolish in situations where being wrong doesn't kill you.

Be serious, skeptical, empirical situations that can have a detrimental effect on your life. Don't predict what's impossible to predict (even by experts) link to Decisive Ooch.

In unpredictable situations use the tools described in other notes.

Implement the "barbell strategy": be hyper-conservative in 1 and extremely aggressive in 2.

Barbell strategy: being hyper-aggressive and hyper-conservative instead of being mildly aggressive or conservative. On one hand, you’re creating a safe ground investing 80-90% of your capital into extremely safe instruments—that is your insurance policy against negative black swans. On the other hand, you’re generating a serendipity attraction machine investing 10-20% of your portfolio into incredibly speculative bets with extremely high upside (like venture capital, crypto, etc) that way you’re exposing yourself to positive black swans. You have no risk and high risk which averages out to medium risk but contains an exposure to positive Black Swans.

Connects to R: Psychology of Money that said that most gains in life are result of a few inputs—i.e., black swans.

This is a great way to find balance in life. Not to be treated as this jerk who doesn't know how to have fun, who is always serious, who never smiles. Be this jerk only when the thing in question can kill you. Rest of the time, let loose. Be foolish.

This is also a nice heuristic to help you determine where and when to get serious about judgement and decision-making (as opposed to lack of action)

It combines with promotion and prevention mindset from R: Decisive by Chip and Dan Heath. If it's promotion—i.e., creating something—you should prioritize those with low negative impact (because the probably have a higher positive impact) because inaction may cause you leave gains on the table. If it's prevention—i.e., avoiding something—you should prioritize based on impact because inaction can kill you.

How to attract the most black swans as possible?

- Bringing the metaphysical into the physical.

- Saying yes to all opportunities, especially those that offer open-ended outcomes.

- Living in a city and using what it offers over villages—bars, cafes, parties, conferences, other events.

The core principle: you can't know the unknown, since, by definition, it's unknown. However, you can always guess how it might affect you, and you should base your decision on that. I.e., if a Black Swan hits (and if you're in Extremistan it sooner or later will) how can I prepare myself for that? Or, should I enter Extremistan? Or, how can I expose myself to positive black swans. Do not judge whether the black swan can happen, judge how it will affect your life and what you can do about it—avoid or be resilient to a negative one or capitalize on a positive one.

The beauty of Black Swan is that even though you can't know the odds of its occurrence, you can have a clear idea of its consequences. You don't know the odds of financial crisis hitting, but you can imagine how you'll be affected. This information allows you to have more control over you life. You focus on what you can know—the consequences—rather than what you can't know—the probability.

Keep the long term perspective when in Extremistan. You probably won't see results for a long time. But we evolved for each action having a reaction. In extremistan it doesn't happen. It's exponential. What you must do is tell yourself a story that you're going into the right direction. Although you don't see results, it's building up, like water before it starts boiling.

Summary of the approach continue September 27th, 2022

Understand what are Blacks Swans. That they shape reality because they can both kill you (negative Black Swans) and make you successful (positive Black Swans).

Understand that you can't predict them due to your mental limitations (no-one can, even Einstein). You can't know the odds of their occurrence.

What you can do, however, is guess how Black Swans might affect you. You can't predict an earthquake but you can imagine how you'll be affected by it. You can't forecast a financial crisis hitting, but you can envision what it would do to your bank account and life. You can't tell in advance X but you can picture Y [generate 5 more examples]. (what about positive Black Swans? Is the same example adequate? )

What's more, when you understand the nature of Black Swans, you can use them to your advantage. You see, there are not only negative Black Swans but there are also Black Swans of a positive nature; those that can have an extremely positive impact on your life. In society we sometimes call it luck or serendipity or over-night success (but these things are not the same, the former is really luck but the latter is compound interest so the success is only over-night for the spectators, not for the successful)

Is luck also the consequence of compounding or is it only network effect

However, to evaluate Black Swans' impact you must learn to determine where they reside. That's when the knowledge of Mediocristan and Extremistan come into play. Black Swans live in the latter but we evolved for the former—hence our inability to predict them. [A little bit more about the two environments]

Once you know what Black Swans are, that you cannot predict them but can guess their consequences (both negative and positive), and you understand what environments can produce them it's time to give you some tools to thrive in the Black Swan dominated world. [this is what Processized is about]

Get back here, man! September 30th, 2022

In general it goes like this: be paranoid only in areas where things can significantly hurt you; stay foolish, stay human in everything else. Seek areas with more uplift than downside, and play the long term game. Expose yourself to as many positive Black Swans as possible.

Or simplify it more.

Be paranoid in areas where things can significantly kill you. This means, insure yourself against unexpected events.

Be skeptical and empirical, while staying open-minded in Extremistan.

Invest hyper-aggressively in areas that have more upside than downside.

Being paranoid means insuring against unexpected events in areas that can kill you.

Being paranoid means X you ludic fallacy with skepticism and empiricism

Ok again,

Be hyper-conservative

Avoid

Insure

Skeptical

Empirical

Be hyper-aggressive

Invite: seize any opportunity

Mindset: Be openminded, be empirical, be skeptical

Take a long term perspective

More upside than downside

Lack of visible volatility doesn't equal lack of risk

Ok again

Be extreme, not average: barbel strategy

Be hyper-conservative

Be hyper-aggressive

Be skeptical

Stop

Prevent the ludic falacy

Be empirical

Test + Positive Black Swan exposure

Test - Negative Black Swan exposure

Mitigate the ludic fallacy

Be open-minded

Say yes + Positive Black Swan exposure

Be long-term

Long-term + Positive Black Swan exposure

More upside than downside

Lack of visible volatility doesn't equal lack of risk

No the best is

Avoid negative Black Swans. To avoid them you need to be paranoid and hyper-conservative in areas where unexpected events can significantly hurt you.

Invest most of your resources into something extremely safe.

Be skeptical about any predictions. Remember, we can't predict Black Swans, since, by definition, they're unknown.

Be skeptical about your intuitions when in a Black Swan area.

Ooch to expose unknown unknowns

Denarrate to minimize the narrative fallacy. Reduce the input.

Cue your System 2 into action when faced with complex decisions.

Ooching is the best.

There are going to be more tactics to fight one's biases based on R: Decisive by Chip and Dan Heath, R: Thinking Fast and Slow by Daniel Kahneman, and others.

Ooch

Invite

Say yes

Do things

Listen

To experts in Medio

Stay foolish

The first tool is the barbell strategy which in english means avoiding negative Black Swans and increasing your exposure to positive Black Swans. More: TK P: Barbell Strategy

How to avoid negative Black Swans

Approach: Hyper-conservative,

Combining skepticism and empiricism.

Tactics

Ooching

If you can't avoid it (you can't avoid a financial crisis), insure.

By reducing the amount of stimuli (e.g., through NSD), you will be more likely to notice the non-sensational because you'll be more sensitive to it. Nice! NSD

Avoid the ludic fallacy through denaration Black Swan Processized:

To become a better thinker: denarrate, nudge system 1 out of the important decisions, train yourself to spot the difference between the sensational and the empirical

The narrative fallacy seems to be the glue between all other fallacies, therefore, we need to stop it! The sensationlization is the trigger. The tunnel vision is the engine.

If you're constantly bombarded by noise (data noise) you're killing your judgement abilities because we judge mostly subconsciously. Each input alters how your brain works.

Because of the narrative fallacy we can't help but create theories and conclusions. We also do it when presented with weak, noisy data. What's worse, because of the confirmation bias we often stick to those explanations even when presented with better and more accurate evidence. Therefore, it's better to refrain from forming theories too quickly.

The WRAP methodology is great there especially Widen your options and Reality-test your assumptions. R: Decisive by Chip and Dan Heath

Maybe also leaving things unfinished and times of slack to give your mind time. To wait for more information.

Avoid the ludic fallacy through testing Black Swan Processized:

The ludic fallacy is the combination of all of the causes that makes us unable to see Black Swans. We simply can't accept randomness (or our cognitive limitations that makes us unable to compute all of the variables); we put the sensational over the abstract; we lazily X to tunnel vision; and we arrogantly think that we know it all and have everything under our control.

We love the sensational, emotional, narrated. We aren't built to understand the abstract—we need context. Randomness and uncertainty are abstractions because we don't see them, we can't touch them, we can't feel them. We only look at what has happened and not what could have happen; we notice only those who succeeded while ignoring those who lost (survivorship bias); we favor information that confirms our beliefs, while rejecting that which disconfirms it (confirmation bias); we prioritize salient things, inhibiting others (priming/availability bias [is this leading to narrative])what else (?) Why? Because our brains evolved in a way simpler environment in which abstract thinking wasn't as necessary as it is now—most things were tangible, sensational, emotional: we were living in Mediocristan. Further, computing both what is seen and what isn't is way more costly.

And because of that we fall for the ludic fallacy—we simplify reality, ridding it of the uncertainties and randomness.

Btw., list out all principles

P: Bring the metaphysical into the physical is the ultimate cure for the ludic fallacy. Nothing can tell you more about the validity of your theories than implementing them in the real world.

One's aim, especially if they frequently reside in Extremistan, is to design small experiments to test their hypotheses (i.e., to Ooch R: Decisive by Chip and Dan Heath). Wanna become a laywer? Before applying to college, try an internship at a law firm. Wanna become a writer? Before quitting your job, try to write after hours for 3 months and get 10 readers. Wanna become a vegan? Before throwing out all animal foods try to eat vegetables for a week. Wanna move out to Italy? Before selling your home and quitting your job go there for 1 month and see if you like it. And so on.

Is theory necessary to make the 'jump' of logic, to figure out that something that doesn't exist might be possible and why. In other words, it's a prerequisite for hypotheses. And it should stay a prerequisite until it's validated empirically. P: Bring the metaphysical into the physical

How to invite positive Black Swans

Approach: Hyper-aggressive, open

Mindset: Growth mindset (because you're potentially antifragile), stoicism, long term vision

Catch Positive Black Swans through doing. Wanna get lucky? Do.

By doing something you know (an objective or hypothesis) you find something that you didn't was there.

This shows that our platonicity and ludic fallacy—ridding reality of Black Swans through simplification due to our cognitive limitations—can work in our favor. You see, the hypothesis that hid BS could hide BS of the positive kind. When you test your hypothesis—implement it in reality—those BS get uncovered, leading to new things. The new things can be innovative on their own or they can act as a spare part (that was previously missing) to spark a novel idea. (PN: Most new ideas are incomplete)

- The important feature of creativity—it's serendiputous. PN: Times of slack for serendipity

- Secondly, this excerpt shows the recipe for creativity. In short, you must do stuff. Like in PN: How to get startup ideas, it's best to work on what interests you and keep living in the future. By building—i.e., externalizing your ideas in the physical world—you will discover things that only reality can disguise to you like in P: Bring the metaphysical into the physical

- Does bringing the metaphysical into the physical work because we expose the ludic fallacy? Those idealized but simplified pieces of reality get uncovered and this is where inventions hide?

- This shows that you have to have projects that you execute because they are what ena le serendipity. Putting thoughts into action in rral life can trigger new combinations like billiard balls hitting each other

- therefore do shit. Ship stuff. Execute. Implement and be ready for inspiration to come. Not the other way around. This is the cardinal rule.

- This also shows the side product of goals. You want to achieve on thing but you achieve another, unexpected because diving into reality shows you that your idealized goal was inaccurate, which is now irrelevant cuz you achieved more than you initially set out to.

- This is also an argument to "ship first, iterate later" because it speaks to implementing and being open to opportunities presenting themselves.

- Design your personal life and your professional team work so that serendipity can easily occur. Maximize different inputs—not only ideas but also places experiences trips places etc.

- The best way to maximize it is to do as much stuff as possible. Doing, implementing, bringing the metaphysical into the physical will produce the most serendipity.

- Also here it's important to be receptive to that serendipity. And one of the best ways for that is NSD TK PN: NSD makes you more creative

- Writing is an intermediate form of bringing the metaphysical into the physical.

- The best way to maximize it is to do as much stuff as possible. Doing, implementing, bringing the metaphysical into the physical will produce the most serendipity.

- This is also why you should try, ship, and implement frequently—you don't know what awaits you in the gap between your idea and reality.

- By bringing the metaphysical into the physical you are uncovering the gap between the idea and reality—and this is where the gold (learnings, new ideas, etc.) lies.

Catch Positive Black Swans through saying yes.

Catch Positive Black Swans through saving.

Catch Positive Black Swans through living in liquid environments.

Go through each bias one by one.

Btw., looking what people tell me at work, I'm amazing and clear communication. In making complex things clear. In identifying problems, creating solutions, and communicating them clearly. I'm not that good at executing them though Muney/Career: Hippo 2023 Planning

Tacitcs

MVP

Liquid environments

fd

Seize any opportunity

“Seize any opportunity, or anything that looks like opportunity. They are rare, much rarer than you think. Remember that positive Black Swans have a necessary first step: you need to be exposed to them.” (pp. 206–210)

Exploit asymmetry

The common thread to these recommendations is to exploit asymmetry: expose yourself to situations where the upside is much greater than the downside. At a higher-level, the key insights he shares are:

“The strategy for the discoverers and entrepreneurs is to … focus on maximum tinkering and recognizing opportunities when they present themselves. So I disagree with the followers of Marx and those of Adam Smith: the reason free markets work is because they allow people to be lucky, thanks to aggressive trial and error, not by giving rewards or “incentives” for skill. The strategy is, then, to tinker as much as possible and try to collect as many Black Swan opportunities as you can.” (pg. xxii)

“This idea that in order to make a decision you need to focus on the consequences (which you can know) rather than the probability (which you can’t know) is the central idea of uncertainty.” (pg. 211)

Look for asymmetric bets where the upside is greater than the downside.

Exposure yourself to positive Black Swans through serendipity.

“I am very aggressive when I can gain exposure to positive Black Swans — when a failure would be of small moment — and very conservative when I am under threat from a negative Black Swan.” (pg. 296)

He recommends

Respect the long-lived (e.g., elders, or nature) and learn from them

Avoid optimization; love redundancy

Avoid prediction of low-probability payoffs

Beware of atypical remote events

Beware of the moral hazard of bonus payments (for short term results)

Avoid risk metrics

Beware underestimation of the true likelihood of negative Black Swans

Don’t confuse absence of volatility with absence of risk

Beware numbers purporting to represent risk

How to thrive in Extremistan

How to listen

How to stay foolish

Relevant notes (PN: )

Referenced in

P: What is a Black Swan

The most important thing Black Swans teach us is that impact is more important than probability. Therefore, we need to adjust to their existence instead of naively trying to predict them. In short, increase your exposure to the positive kind of Black Swans (while keeping a safety net) and avoid areas where Black Swans that can kill you exist.